For yourself, but also for others, a very important question; how good is this business idea really?

In this blog I will tell you how we assess startups.

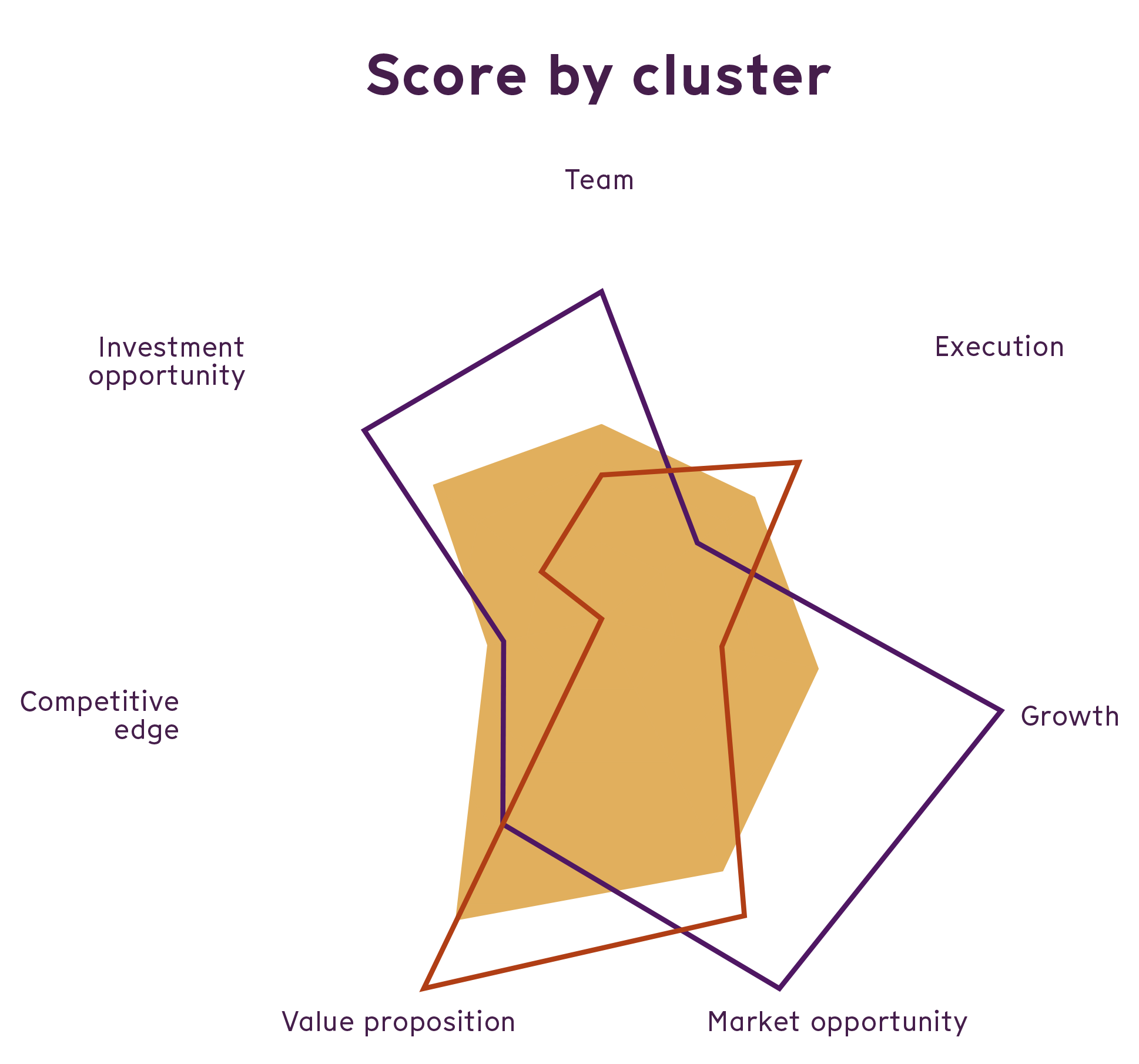

When I assess startups on behalf of Golden Egg Check or LaunchPlatform, I use the assessment we created. The assessment consists of a number of criteria that investors, Venture Capital but also angels, use to decide whether or not to invest in a startup. This assessment consists of 7 clusters with 3 dimensions per cluster. We use this to assess the feasibility and potential of a startup. With this assessment we help Dutch incubators and accelerators to select the best startups for their programs, we help investors to scout promising startups and finally it gives the startup itself insight in what they can still work on.

The Criteria

Good teams with committed entrepreneurs who have relevant domain knowledge and strong track record, as well as complementary areas of expertise

Strong execution – teams with ambition and a solid go-to-market/growth strategy, and who are able to identify and manage risks

Startups with growth potential, including internationally, and a scalable business model

A large market opportunity – startups that have a clear target market, whose reach is large and growing

A clear and compelling value proposition – startups that solve a painful problem for the customer and can demonstrate market demand

Strong competitive advantage – startups with a superior value proposition that they can protect against competitors, and that can garner an attractive position in their value chain

An attractive investment opportunity – startups with credible and attractive financial prospects and exit potential

Type of startups.

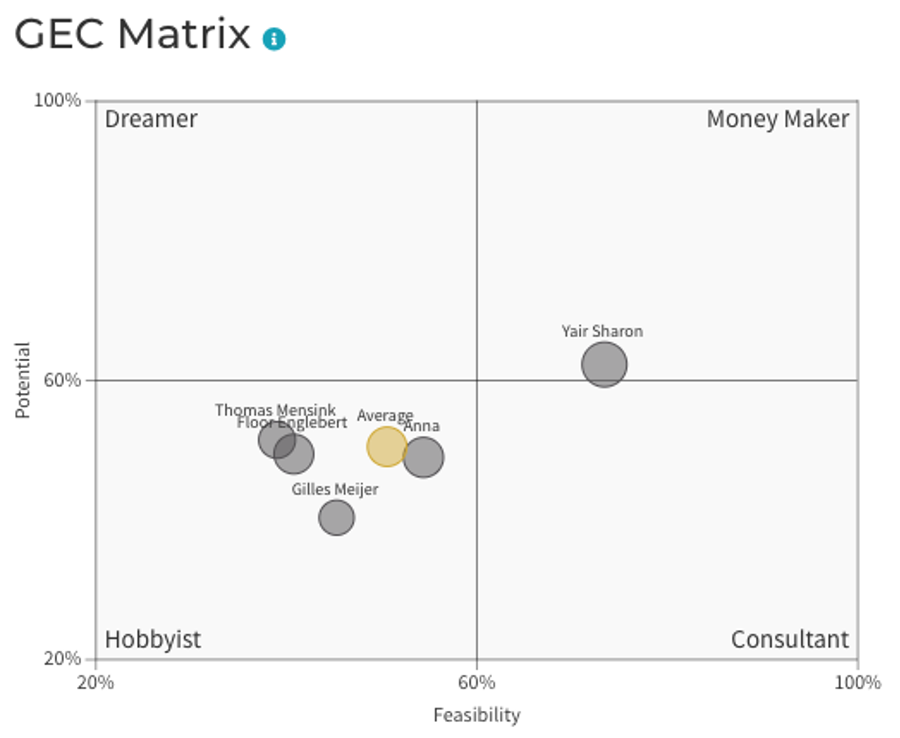

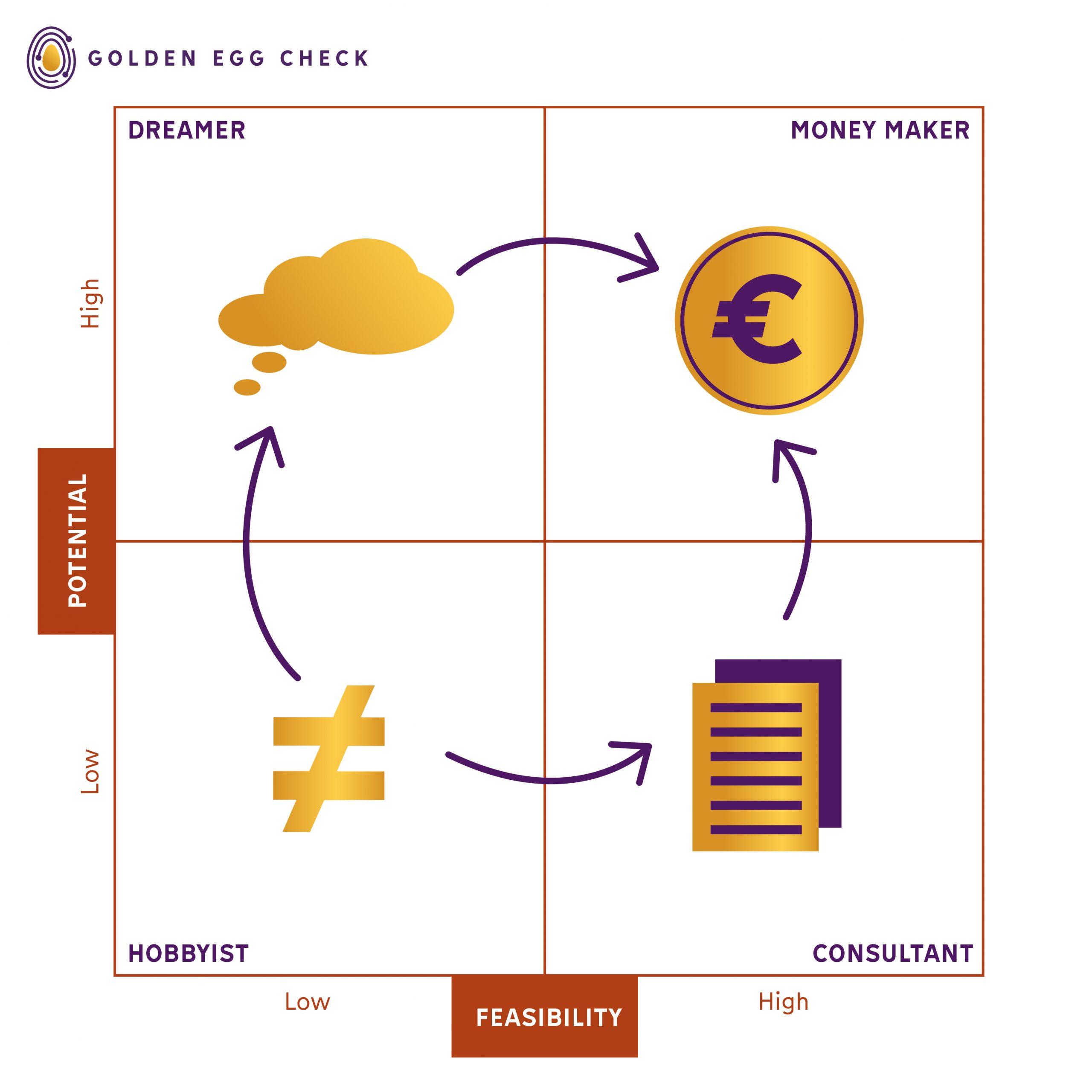

The clusters in the assessment have been assigned a certain weighting factor and categorized by feasibility or potential, which makes it possible to categorize the startups. We distinguish 4 types of startups:

Hobbyist:

This is a startup with limited feasibility and potential. The commercial success of this type of startup is expected to be low, the concept of this startup needs to be strongly refined. Often this is due to sketchy explanations of the idea, a poor product-market fit, lack of evidence that it works, no proper research or missing factors in the team or their areas of expertise. In lean startup terminology: it’s time for validation and possibly a pivot. Sometimes a pivot on a crucial topic is enough to classify as another category. The goal of the hobbyist is to get the idea sharper and classify it as a consultant or dreamer.

Consultant:

This type of startup generates enough money in the short term, but lacks an interesting commercial (growth) perspective in the long term. This can be interesting for the short term, but is not a startup to invest in for a typical venture capitalist unless the long-term benefits can be magnified. These startups are characterized by a good product-market fit, but a business model that is constrained by capacity, for example in terms of hours or employees. Employee-based consulting will typically scale linearly (each employee can only work so many hours). So often there is no real technology solution and associated (scalable) revenue model here. Keep in mind that this can be a low-risk type of startup where you can make plenty of money and enjoy your career, which can be great for many (aspiring) entrepreneurs.

Dreamer:

This is a common type of (innovative) startup: success is projected over the long term, but the startup has low short-term feasibility. This can be problematic, as the startup’s potential cannot (fully) be reached due to liquidity issues. A typical chicken/egg problem; if it succeeds it’s great, but prove it. To gather evidence you need time (and money), but for many investors it is still too risky.

Many high-tech startups are in this quadrant, where they have a long time-to-market and have to dig deep to get their first customers. However, should they manage to overcome this ‘valley of death’, the expectation is that they will grow exponentially over time.

Money Maker:

This startup has both long-term potential and a solid strategy to achieve it. Simply put, this startup scores very well on all clusters. As a startup, you should ideally be in the Money Maker quadrant.

Wrap-up

Now that you’ve read what you as a startup should be assessed on, it’s useful to find out for yourself how well you score on this. Are you still in the idea phase and are you still building your startup? Then we can do this together in the LaunchPlatform.

If your startup is already a bit further on and thinks (based on our clusters) it will be attractive for investors, please contact us. You might be eligible for a speed date with investors via StartupRoulette.

For startups:

Make sure you selectively value external advice. Check for yourself if you ‘check the boxes’ of our criteria and especially check if this is visible to the outside world (incubators, accelerators, investors or future partners).

Team:

Perhaps you or your co-founder have a certain expertise, but don’t mention it on your website, LinkedIn or pitch deck. Stay humble, but show what you have to offer. Add advisors, mentors to fill the “gaps” in your resumes.

Execute:

Share your vision, goals and achievement of your milestones through blogs or via LinkedIn or other socials. This will allow you to retroactively prove that you are committed to living up to your ambitions.

Growth potential:

Provide a scalable business and revenue model. Try to realize as much impact as possible with as little effort as possible. Not scalable yet? Share your vision to turn your knowledge into products.

Market opportunity:

Make sure you have researched your market through both desk and field research, let the results of this come back in bullet points in your presentation or pitch deck and make sure you have mapped your TAM, SAM and SOM. Make your market reach, what can you achieve in the next 2 years?

Value Proposition:

Investors love ‘problem solvers’ aka ‘need-to-have’ -solutions’ this market is often bigger than ‘nice-to-have’ -solutions. Make sure you solve a substantial problem for a large target group, which will preferably grow for years and may even want to repeatedly call on your solution.

Competitive advantage:

You always have competitors, direct or indirect. Acknowledge them, learn from their best practices and mistakes. Stand out in one essential area rather than a little bit everywhere. Dare to admit that it is a competitor, but that you are simply better at a crucial part.

Investment opportunity:

An investor is most easily convinced by demonstrable monthly recurring revenue. Unfortunately, this is often not yet the case for early-stage startups. Make the financials realistic, know what you are doing and convince investors based on your execution and plans.

For coaches/judges:

It is human nature to reason from your own perspective. Be critical in the way you judge pitching startups or startup entrepreneurs. If you don’t believe in the concept, what’s the reason? Do you not believe in the solution or the problem-statement? Ask about the customer research and judge it. Don’t believe in the potential? Ask about the market data. Don’t believe in the entrepreneur’s ability? Ask about the vision, ambition and results already achieved.

Judge on numbers, facts or progression. Not on personal opinions, experiences or frames of reference. It is not the job of a coach to think an idea is good or bad. An idea is 1%, execution is 99%.

Now did you find this a valuable blog? If so, leave a like or positive comment on my LinkedIn post about this blog, and it will come to the attention of others too! Thanks :)!

Yaïr Sharon

LaunchPlatform – Push to Start!